Blog

NAR Leadership Hosts Online Event to Discuss Proposed Budget, Dues Increase

April 12, 2018

NAR President Elizabeth Mendenhall and other members of the NAR Leadership Team recently discussed the association’s proposed 2019 S.M.A.R.T. Initiatives (Strategic Measures Advancing REALTORS®), during a Facebook Live program rec The budget to support S.M.A.R.T, which includes a proposed $30 dues increase to be voted on by NAR’s Board of Directors on Saturday, May 19th, focuses […]

NAR Hits Pause on Updating Iconic REALTOR® Logo

April 9, 2018

In response to concerns raised by members, the National Association of REALTORS® announced that it’s pausing the rollout of a newly redesigned logo picture to the right. NAR leadership states: Since we announced the brand evolution and logo redesign, we have received a diversity of opinions that ranged from strong support to outright disapproval. Please […]

Virginia General Assembly Wrap-Up

April 6, 2018

The 2018 Virginia General Assembly was extremely successful for the Virginia REALTORS®. VR’s Policy and Advocacy team worked hard to defend the rights of both REALTORS® and property owners. They also reviewed an impressive 213 bills, and all seven of the initiatives introduced as bills by the Virginia REALTORS® have passed. Click here to access the […]

You’re Invited: Learn Why the Loudoun 2040 Plan is Important to You, 4/3, 9:30AM

April 2, 2018

On Wednesday, April 3, 2019, members of the Government Affairs Committee will meet with Jeffrey Salmon, Loudoun County Planning Commissioner. The Committee invited Jeff in order to learn about the draft Loudoun 2040 Comprehensive Plan. The draft Plan includes policies and goals for the future development of Loudoun County. If enacted, it will guide where […]

2018 Flood Insurance Rates Expected to Rise

March 28, 2018

On April 1, 2018, National Flood Insurance Program (NFIP) premium rates are set to rise an average of 8%. This increase is slightly more than last year but consistent with the annual 5-10% increases prior to the 2012 Biggert-Waters Act, which made significant reforms to the NFIP. Under 2014 Flood Insurance Affordability amendments, individual property […]

Passage of FY 2018 Spending Bill Critical Step for Affordable Housing Funding and Flood Reauthorization

March 28, 2018

The U.S. House and Senate voted Thursday to fund the federal government through September 30, 2018. The 2,232-page bill contains important provisions related to housing that REALTORS® have been fighting for, including alleviating the weakening of the Low-Income Housing Tax Credit (LIHTC) from the new tax law, extending the EB5 program, extending the National Flood […]

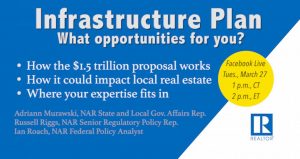

NAR Webinar: $1.5 Trillion Infrastructure Plan: Opportunities for You?

March 21, 2018

The Trump administration has released details on its plan to leverage $200 billion in federal funds to generate $1.3 trillion in local, state, and private investment to improve infrastructure projects around the country. What needs to happen next for this plan to be enacted? Should it be enacted, in its entirety or in part, what […]

NAR Urges Permanent Mortgage Forgiveness Debt Exclusion

March 15, 2018

The exclusion for forgiven home mortgage debt following a foreclosure, short sale or loan modification should be made permanent to provide relief to troubled borrowers and minimize the damage to families, neighborhoods and communities. That’s according to recent testimony(link is external) from the National Association of Realtors® before the U.S. House Ways and Means Subcommittee on Tax […]

MRIS: Bright MLS: Ten Things to Know About the New Coming Soon Listing Status

March 15, 2018

MRIS – Bright MLS Corner: Ten Things to Know About the New Coming Soon Listing Status 1. Properties listed under the Coming Soon status are NOT pocket listings. While pocket listings are only marketed to a select few outside of the MLS, properties under the Coming Soon listing status will be viewable within the MLS […]

REALTORS® and Affiliates honored for their Dedication and Service to the Real Estate Industry

March 15, 2018

The Dulles Area Association of REALTORS® (DAAR) recognized several REALTORS® who reached exceptional levels in the real estate industry in 2017. They were honored and celebrated at the DAAR REALTOR® Awards Reception on Wednesday, March 14, 2018, at 1757 Golf Club in Ashburn. For pictures of the event, click here. The awards include the annual […]