Membership Dues

DAAR REALTOR® New Member Dues

NEW MEMBER? CLICK HERE

|

2025-2026 Virginia REALTORS®, NAR, and DAAR Dues Renewal Information

Thank you for your continued membership and support of the Dulles Area Association of REALTORS® (DAAR).

In June 2025, all DAAR members will receive a dues invoice notification email. This invoice includes local, state, and national membership dues for DAAR, VAR, and NAR. Your local, DAAR REALTOR® dues pay for your membership beginning July 1, 2025 through June 30, 2026.

Please keep in mind that membership dues/fees are not refundable.

Renewal Timeline:

Sales Agents | |

| NAR – Dues | $ 156 |

| NAR – Special Assessment | $ 45 |

| Virginia REALTORS® | $ 203* |

| DAAR | $ 355 |

| Voluntary RPAC | $ 40** |

| $ 799 | |

Managing/Supervising Brokers | |

| NAR | $ 156 |

| NAR – Special Assessment | $ 45 |

| Virginia REALTORS® | $ 203* |

| DAAR | $ 355 |

| Voluntary RPAC | $ 99** |

| $ 858 |

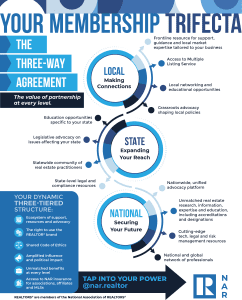

Click here for an overview of REALTOR benefits!

Please note the following disclosures:

National Association of REALTORS® 2026 Disclosure: For 2026, with dues at $156 per member, NAR computes 35 percent or $55 to be nondeductible for the member’s income tax purposes due to NAR lobbying efforts. Please note that the entire $45 Consumer Advertising Campaign special assessment qualifies as fully deductible.

**The NAR Board of Directors at its annual meeting on June 5, 2025, approved NAR’s 2026 budget which keeps the NAR dues unchanged at $156/annual and $45/annual special assessment for the Consumer Ad Campaign. The approved budget also reallocates $35 of the special assessment for NAR’s general operating account. The remaining $10 will go towards the Consumer Ad Campaign.

Virginia REALTORS®: Dues of $203 per member, Virginia REALTORS® computes 12% or $24.36 to be nondeductible for the member’s income taxes due to Virginia REALTORS® lobbying efforts, and political activities. Membership dues are not deductible as charitable contributions but may be deductible as ordinary and necessary business expenses subject to restrictions imposed as a result of association lobbying activities. Note that the entire $203 new member fee qualifies as a deductible expense. For more information, click here to login and view fees (login required).

Dulles Area Association of REALTORS®: Dues of $355 per member, DAAR computes 4.18% or $14.83 to be nondeductible for the member’s income tax purposes due to DAAR lobbying efforts. In addition, contributions (including member dues) to DAAR are not tax deductible as charitable contributions. However, they may be tax deductible under other provisions of the Internal Revenue Code.

**Contributions to Virginia REALTORS® RPAC are voluntary and are used for political purposes; they are not deductible for federal or state income tax purposes. Members may contribute more or less than the suggested amount and may refuse to contribute without reprisal. The National Association of REALTORS® or any of its state associations or local boards will not favor or disfavor any member because of the amount contributed. NAR has established state Federal RPAC Disbursement Allocations based on anticipated National RPAC needs. Thirty percent of all Major Investor contributions are sent to NAR to be applied to the Federal RPAC Disbursement Allocation and are charged against the limits under 52 U.S.C. 30116 with the remaining seventy percent maintained for state and local usage. Decisions regarding Virginia REALTORS® RPAC contributions to meet the Federal RPAC Disbursement Allocation will be made throughout the fundraising year. The contributor certifies that they are at least 18 years old and are making this contribution with their own personal funds- not those of another person or entity, nor are they a foreign national or federal contractor.

Corporate (PAF) Disclaimer:

RPAC of Virginia seeks to encourage REALTORS® to become more active and involved in government at every level; to assist REALTORS® in organizing for more effective political action; to endorse and/or financially support candidates in primary and general elections for state offices; to provide funding for local associations and local association PACs to use in local or state elections and for political issues of local concern; and, to financially assist Virginia REALTORS® or local associations of REALTORS® and local association PACs in their efforts to support or oppose political issues of possible statewide significance. Contributions are not deductible for federal or state income tax purposes. Contributions to RPAC are voluntary and are used for political purposes. You may contribute more or less than the suggested amount. You may refuse to contribute without reprisal and Virginia REALTORS® or local associations will not favor or disfavor anyone because of the amount contributed or a declination to contribute. Any suggested contribution amount is merely a suggestion, and no minimum contribution is required.

If you have any questions about the RPAC Disclaimers, please contact Maura Pratt, Assistant Vice President of RPAC Development & Local Association Advocacy Liaison, at mpratt@virginiarealtors.org.

Questions? Contact us at 703-777-2468 or membersvc@dullesarea.com.