Blog

Commemorate the 50th Anniversary of the Fair Housing Act

March 21, 2018

Join DAAR in Commemorating the Fair Housing Act April 2018 marks the 50th Anniversary of enactment of the Fair Housing Act of 1968. In honor of this tremendous achievement, the Loudoun County Board of Supervisors will present a Resolution commemorating this historic event. Join DAAR for the presentation on Tuesday, April 3, 2018, starting […]

VA Legislative Session Comes to an End – Almost

March 16, 2018

Last week the Virginia General Assembly adjourned for the year. Almost all of the bills advanced by the Virginia REALTORS® this year passed both chambers and were approved by the Governor. Topics include defining Teams, document translations, earnest money deposits, broker education, post-licensing curriculum, civil violations for non-licensed activities, POA/COA summary information, and restrictions to […]

NAR Urges Permanent Mortgage Forgiveness Debt Exclusion

March 15, 2018

The exclusion for forgiven home mortgage debt following a foreclosure, short sale or loan modification should be made permanent to provide relief to troubled borrowers and minimize the damage to families, neighborhoods and communities. That’s according to recent testimony(link is external) from the National Association of Realtors® before the U.S. House Ways and Means Subcommittee on Tax […]

MRIS: Bright MLS: Ten Things to Know About the New Coming Soon Listing Status

March 15, 2018

MRIS – Bright MLS Corner: Ten Things to Know About the New Coming Soon Listing Status 1. Properties listed under the Coming Soon status are NOT pocket listings. While pocket listings are only marketed to a select few outside of the MLS, properties under the Coming Soon listing status will be viewable within the MLS […]

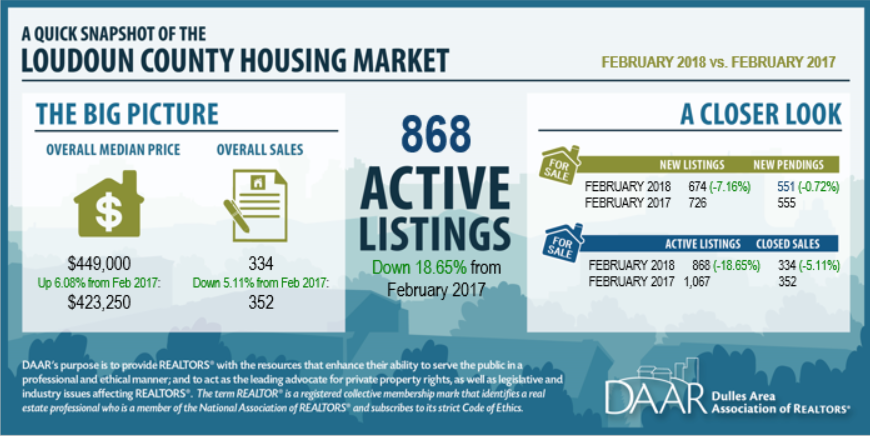

February 2018 Loudoun County Market Trends Report

March 14, 2018

DAAR Housing Market Update – Loudoun February 2018 The following analysis of the Loudoun County, Virginia housing market has been prepared by George Mason University’s Center for Regional Analysis. It was prepared for the Dulles Area Association of REALTORS® by analyzing Bright MLS housing data from MarketStats by ShowingTime. Overview For the 32st consecutive month, active […]

DAAR Weighs in on the Benefit of Additional Staff to Support Housing Programs

March 9, 2018

The FY 2019 Proposed Budget for Loudoun County includes funding for additional staff resources to address one of the most critical needs in Loudoun County – how to provide housing that is affordable. DAAR is pleased to see the inclusion of proposed funds for this purpose. County staff requested funding for five new staff positions […]

Health Insurance Rule Needs Improvement

March 9, 2018

The U.S. Department of Labor’s (DOL) proposal to let more associations offer health plans to their members is encouraging, but changes—such as extending eligibility to self-employed individuals or small-business owners who have access to subsidized insurance through a spouse’s employer plan—are needed, the National Association of REALTORS says in a letter to Secretary of […]

Video: Avoiding Unlicensed Practice of Law

March 9, 2018

The latest Window to the Law video from the National Association of REALTORS Legal Affairs division provides strategies to help real estate licensees avoid activities that could constitute the unlicensed practice of law. You may also view the slide presentation.

Charting the Changes: Bright MLS Provides Important Update to Subscribers

March 9, 2018

The message below was sent to all Bright MLS subscribers providing an an update on past, present and future changes to expect with the system:Over the past year we’ve been busy building the foundation of the new Bright MLS system and on continued alignment of fees and policies across the entire Bright footprint. There have […]

Call to Action: Support the Association Health Plan Rule!

March 4, 2018

In an effort to expand access to more affordable, high-quality health insurance coverage, on January 5, 2018, the U.S. Department of Labor proposed a rule allowing self-employed individuals and small employers to purchase health insurance through professional or trade associations by expanding access to Association Health Plans (AHPs). An AHP plan would be treated as […]