Blog

National Flood Insurance Program Extended to March 23, 2018

February 19, 2018

On February 9, 2019, Congress extended the National Flood Insurance Program (NFIP) as part of a broader budget agreement. NAR is urging the Senate to use the time to work on comprehensive NFIP legislation that provides a 5-year reauthorization and includes meaningful reforms to strengthen the program and open the door to a private market […]

National Flood Insurance Program Extended to January 19, 2018

December 27, 2017

On December 21, 2017, Congress extended the National Flood Insurance Program (NFIP) as part of the continuing resolution to keep the government open through January 19. NAR will continue working with Congress to ensure that the NFIP does not lapse while the Senate works on its version of the 5-year reauthorization and reform measure. Read […]

FHA 2018 Loan Limits

December 27, 2017

On Dec. 7, 2017, the Federal Housing Administration (FHA) released its 2018 Loan Limits, effective January 1, 2018. FHA’s loan limits are tied to the loan limits set by the Federal Housing Finance Agency for conventional mortgages. In high-cost areas the FHA national loan limit “ceiling” will increase to $679,650 from $636,150. FHA will also […]

President Signs the Tax Reform Bill

December 27, 2017

The President signed into law the “Tax Cuts and Jobs Act” on December 22, 2017. All individual provisions of the measure are generally effective after December 31, 2017 for the 2018 tax filing year and expire on December 31, 2025 unless otherwise noted. The provisions do not affect tax filings for 2017 unless noted. To read […]

Tax Reform Bill: Vote on Final Passage Expected This Week

December 18, 2017

The 1,000+ page Conference Committee Report on the Tax Reform Bill is expected to be voted on this week in the U.S. Senate and House of Representatives. NAR believes that many improvements were made from the prior bills and remains concerned that it will present problems for homeowners and the broader housing market. Read more […]

Call for Action – NAR Opposes the Final Tax Reform Bill

December 5, 2017

A new Call for Action launched on Monday, December 4. Join with NAR in opposing the Conference Committee Report when it comes up for a vote in both the House and Senate! Tell your members of Congress that incentives for homeownership and the capital gains tax exclusion on the sale of a home MUST be protected. […]

NAR Call for Action: Reform Our Tax Code AND Protect Middle Class Homeowners!

October 18, 2017

Take action and send the message to Congress: Don’t raise taxes on middle class homeowners! On, Wednesday, October 18, 2017, NAR launched a Call For Action to all REALTORS® to take action and send Congress a message. Please join the Call For Action with your fellow REALTORS® and sign up for the REALTOR® Party Mobile Alerts […]

Millions of Middle-Income Homeowners Stand to Lose Under “Big 6” Tax Proposal

September 28, 2017

A group of legislators and administration leaders known as the “Big 6” released last week an outline for comprehensive tax reform that if enacted, according to the National Association of Realtors®, could lead to a tax on homeownership for millions. According to the Big 6’s framework for tax reform, changes to the current tax code […]

National Flood Insurance Program Extension Moves Forward

September 8, 2017

On Thursday, September 7, the United States Senate voted to pass a three-month extension of the National Flood Insurance Program (NFIP). The House of Representatives passed the legislation on Friday, September 8, 2017 and the President signed the bill into law later that day. This legislation ensures that the NFIP will not lapse on September 30, 2017, […]

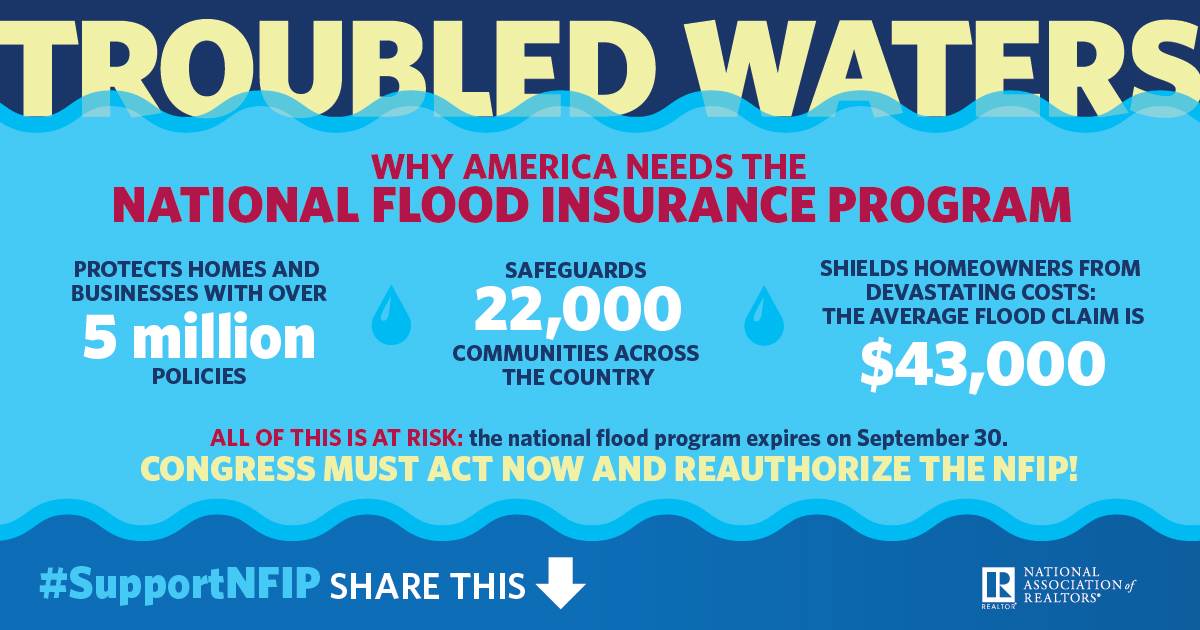

Turn the Tide: Tell Congress to Reauthorize the NFIP

August 31, 2017

Please take action and tell your Member of Congress that the National Association of REALTORS® (NAR) supports H.R. 2874, “The 21st Century Flood Reform Act.” The Problem: The National Flood Insurance Program (NFIP) is scheduled to expire on September 30, 2017. Millions of home and small business owners in more than 20,000 communities nationwide require […]