Blog

Bright MLS Release Notes as of January 31st: Corrections and Improvements

January 31, 2019

The following release notes describing corrections and improvements to the Bright MLS system were made as of January 31st: Agent and Client Gallery Reports. Because of your feedback, we’ve added the Agent and Client Gallery Reports to your report options in Bright. These reports offer more listing information than the Thumbnail Report in a format […]

Virginia REALTORS® Advocate on Behalf of the Industry

January 26, 2019

The 2019 Virginia General Assembly Session has begun and all of the bills advanced by the Virginia REALTORS® are moving! This session will be ‘short,’ only lasting 46 days. It is scheduled to end on Saturday, February 23rd. Join us in Richmond to help advocate on behalf of your business at the 2019 Virginia REALTORS® […]

Obtain Answers and Insight in the Bright MLS Community Facebook Group

January 24, 2019

Bright MLS recently launched a closed Facebook group for the Bright MLS community, created and moderated by expert Bright MLS staff. Bright MLS subscribers can join by clicking here and providing their subscriber ID https://www.facebook.com/groups/BrightMLSCommunity The description reads: Think of this group as a two-way platform where Bright can share with you, and you with […]

Virginia REALTORS® Chief Economist Breaks Down the Truth About HQ2

January 17, 2019

The announcement of Amazon’s HQ2 coming to Virginia has been dominating media stories across the Commonwealth. Reports of dramatic changes ahead for the housing market have REALTORS® and sellers on the edge of their seats… but are those reports accurate? Virginia REALTORS® new Chief Economist, Dr. Lisa Sturtevant, recently attended a forum on Amazon and […]

Did you Know? Listing Agents Can Use a CBS Code for Extra Layer of Security

January 16, 2019

The call before showing code (CBS code) is an additional code you may need to enter before you can access the key compartment of a lockbox. It is an extra layer of security on the lockbox requiring an additional code before the key compartment will open. Not all lockboxes use a CBS code. A […]

DAAR Member Linda Thornell Earns GRI Designation

January 15, 2019

The Dulles Area Association of REALTORS® is pleased to announce that Linda Thornell, McEnearney Associates, Lessburg, completed the REALTORS® Institute of Virginia program and have earned the Graduate REALTOR® Institute (GRI) designation. “Completion of the coursework for the GRI designation represents a commitment to industry knowledge and professionalism that not all agents make,” said Beckwith […]

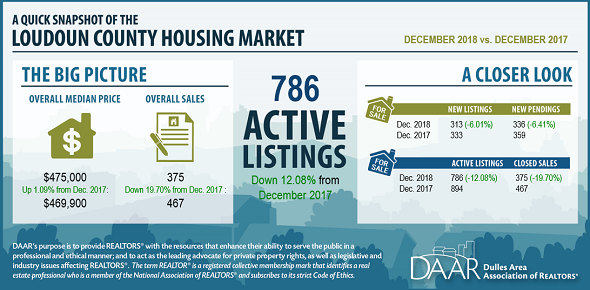

December 2018 Loudoun County Market Trends Report: Active Listings Lowest in Over a Decade

January 15, 2019

Overview Inventory continued to tighten in December, despite a modest increase in new listings in November. There were only 786 active listings in Loudoun County in December 2018, the fewest active listings in over a decade for any month. The number of active listings declined 12.1 percent from December 2017 to December 2018; declines were […]

We’re in Session: Join us in Richmond for the Chance to Advocate on Behalf of Your Business

January 9, 2019

Learn what’s ahead for your industry, engage with lawmakers and join Virginia REALTORS President Beckwith Bolle (2013 DAAR President) by taking part in the Virginia REALTORS 2019 Economic & Advocacy Summit on February 6th in Richmond, VA. This event offers education from industry experts and the chance to participate in town hall sessions with local legislators […]

Bright MLS: Legal Subdivision Now Available on Reports and in Listing Search

January 9, 2019

Based on your feedback, Legal Subdivision is now available on the main search screen. It has also been added to listings, where the information was previously available in MRIS and will autofill from the Bright tax record in Listing Management going forward. This is a non-editable field which contains information from a listing’s county assessment […]

Bright Launches LIVE YouTube Hands-on Clinics in January

January 4, 2019

Bright is launching interactive Training Clinics on YouTube! Join Bright as they host these virtual “hands-on” clinics that will cover time-saving tips and tricks, answers to top support center questions, and a live Q&A from bright instructors. Monday, January 7th, 14th, 21st, and 28th at 10:00 a.m. Wednesday, January 9th, 16th, 23rd, and 30th at […]